Those who are associated with the trading word can always relate themselves with the term “Options Greeks”. However, those who are relatively new and want to get deep into this domain can always use a trick or two about these. To cover everything as we proceed, options are a particular type of derivative security. In other words, an option works as a contract that grants the right to sell a share at a set price on or before a set date. It is always a right and not an obligation, which is how it got the name “option”.

Types of Options

- Call Option: This determines the right to buy a stock or share as per the need

- Put Option: This determines the right to sell a stock or share as per the need

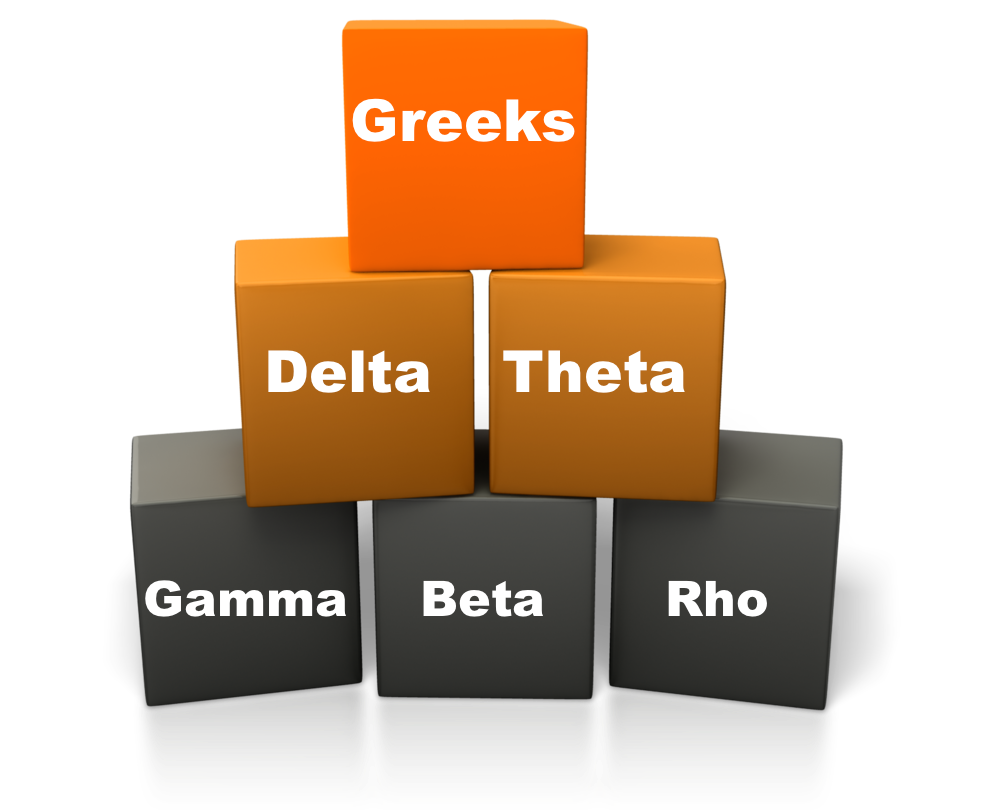

But how can one set the value of an option without knowing what will happen to a stock or a share in the future. These concerns are addressed by four different elements that govern the rules for setting the price. Let’s take a look at these one by one

- Options Greeks – Delta Element: The Delta is a form of measurement that deduces the cost of the underlying stock, and how this cost changes when the stock moves. When one calls a buy option and the stock surges in its cost, the option too increases in the value, and vice versa.

- Options Greeks – Vega Element: This element measures that rate at which the cost of an underlying stock changes when it moves. This way, one can use this element to determine how quickly he can make more money on a soaring stock or share value by investing on it.

- Options Greeks – Theta Element: This determines the validity of an option. This way, once can know how much time he has for buying a stock before it expires in value. Investing in a stock that has a validity of a couple of days won’t appear like an ideal one to put the money on.

- Options Greeks – Gamma Element: While the other three depends on the stock value and its validity, Gamma has more to do with the value of Delta. The rate at which the value of delta changes determines the gamma value. This is indeed much complex and must be dealt only by a professional.

Concluding

Stock trading is all about risks. Doing it with Greek Options can make sure that a person knows exactly what he is dealing with, and how he can make an ideal decision related to it.

1 Comment

Comments are closed.