Most individuals opt for retirement when they are between 55 and 65 years of age. Planned investments enable you to self-fund your post-retirement expenses. If you’re looking for the best schemes and investment plans for your retirement, these 6 tips will help you keep your finances on track post-retirement.

- Organise your Retirement Expenses

Make it a point to list down all your expenses and create a financial plan containing all you need and everything you want to do after you retire at least 10 years before retirement. This plan can provide you with a better sense of direction when it comes to investments and savings. Forecast your rent, monthly living expenses and medical expenses and keep a margin for unpredictable expenses too.

- Figure out what you have and what you Need

Soon after creating a financial plan, check all your investments and income, your employee provident fund, your health insurance kenya and assets. Add up everything to see what your retirement corpus currently looks like, and what you need to add. This will help you put a figure to the spread of your investments and work more efficiently towards retirement.

- Amp up the Contributions towards your Retirement Fund

As your income increases, you are likely to increase your spending. However, rather than fall into this common trap, reduce wasteful expenditure and contribute more income towards retirement.

- Consider High Yielding, Safe Options for Those Above 60

At this age, you may already have a diversified investment portfolio with a mix of low-risk and high-risk investments. However, it is now time to change your investments to safer options that also promise you a monthly or quarterly payout to take care of your post retirement expenses.

There are a lot of safe options to choose from for those above 60, like the Post Office Monthly Income Scheme, Senior Citizen Saving Scheme, Senior Citizen FD scheme and non-cumulative company Fixed Deposits. Ensure that you invest in them and save on taxes apart from getting stable earnings that are not dependant on the market.

A non-cumulative Bajaj Finance Fixed Deposit can be a great way to invest your PF money and get ample income earnings to fund your life post retirement. This FD further offers up to 8.10% interest for senior citizens along with a doorstep service and high stability ratings.

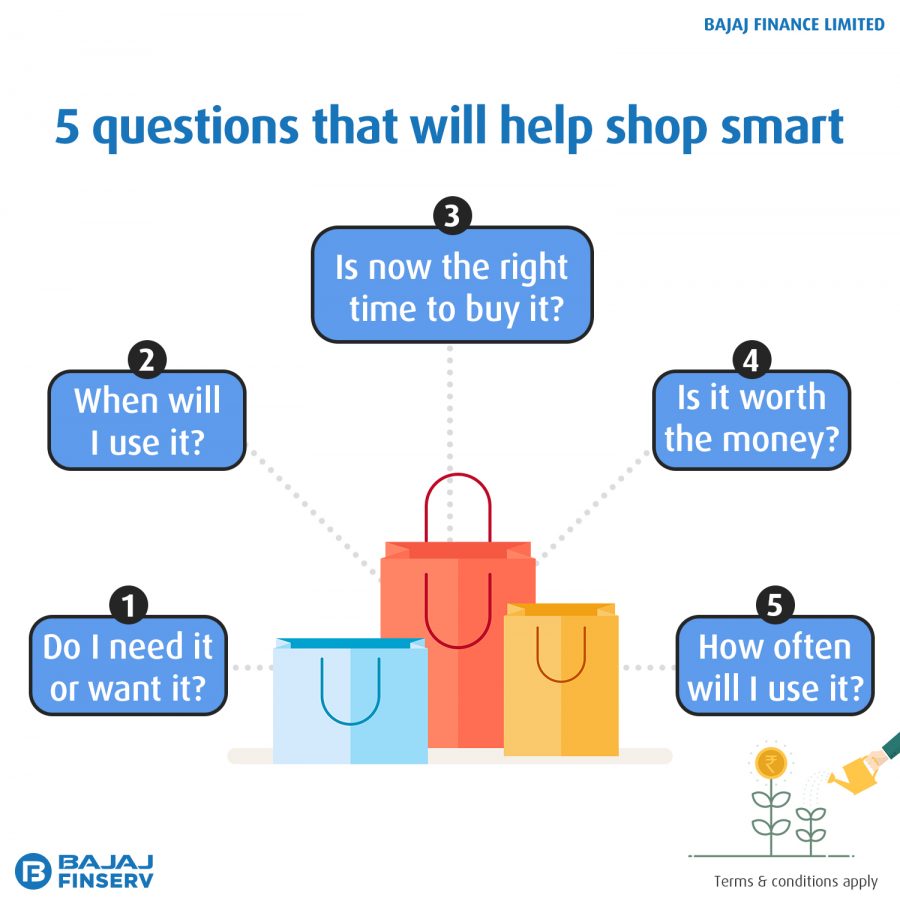

- Make a Roadmap to Cut down your Expenses During Retirement

Now is the right time to reconsider your expenses and chalk out how you can regulate them. Small changes in your lifestyle will ensure that you save money. For example, if you find that you spend Rs.500 on movies every week and Rs.1,000 on eating out, eliminating this expense can help you save Rs.6,000 every month. Shop smartly and tweak your phone and Internet plans to yield maximum benefits!

- Pay off High-Interest Debts:

Now is the time for you to also ensure that you don’t have any pending high-interest debt either due to overdue credit card bills or via a loan. If you need a take a low-interest debt consolidation loan to clear these, or cash in an investment to pay it off, do so immediately. Once you retire, this debt will weigh more heavily on you.

These six measures will help you retire with ease. While you plan your finances, take the prudent step and consider investing in a high-yielding investment plan.