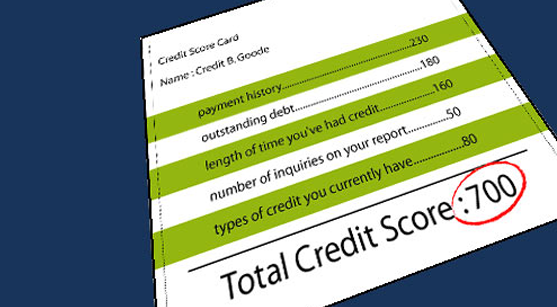

Despite having a steady income and making timely payments, certain people get the shock of their lives when their credit scores dips suddenly or when previously unknown facts are highlighted by the bank that they apply for a loan/credit card with. The number of factors that affect your credit score is many. Unfortunately, there is an increase in the number of complications that can plague credit scores too. Here are some widely unknown reasons why your credit scores take a beating unexpectedly:

-

Closure of credit cards and accounts – The number of lines of credit you have is a double-edged sword. Having too many can create a problem just as having too less or none can. Closing credit cards and long-standing bank accounts can be a problem. For one reason – you are decreasing a good factor which is the age of your credit – longer the better. Let’s explain the second reason with a short example. If you have 6 credit cards with a combined credit limit of INR 6 lakhs and have a current balance of INR 1.5 lakhs, you’ve used just 25% of the available credit to you which is a good percentage. Cancel three of the 6 cards and that percentage suddenly shoots up to 33.33%. This sudden increase and high % has a negative impact on your credit score.

-

Not having any loan or credit card – A total lack of any type of credit history on the other hand is also a problem. CIBIL must be able to trace some credit activity for a minimum of 6 months to be able to assign a score to you. People who do not have any type of loan or credit card can try to apply for their credit information report (CIR) but the response they are most likely to get is there is No History and cannot provide your CIBIL report. Without this standard method of ascertaining your credibility, your chances of getting any new line of credit takes a serious blow.

-

Repeatedly applying for loans or increase in credit limits – Did you know that lending institutions registered with CIBIL are obliged to report each time a person makes any such equity to CBIL? Each of these enquiries is known as a “hard enquiry” and the more such enquiries you make, the more your score gets impacted. Banks assume that you are eager to lead a life of credit rather than income and consider you a bad risk.

-

Not checking your CIR – It is your responsibility to keep a track of your credit score and keep an eagle-eyed watch on your CIR at all times. It does not mean you apply for a report every month. But periodically, say once a year or before you apply for a big loan, it is advisable to check your CIBIL credit score rating so you can spot any frauds or irregularities and get them sorted with CIBIL straightaway before their affect your score in a negative way.

So, it is not only important to keep track of your expenses and work on increasing your income – You should also pay attention to what gets reported about you and how you balance your current loan balances against the available credit limits you have. Contact your financial advisor or credit repair companies for more guidance, today.